Test Automation Case Study: Payment Testing Transformation at a Major Card Company

1. Introduction: AI Test Automation in Financial Services

Financial institutions face mounting pressure to deliver flawless digital payment experiences.

Manual QA processes can no longer keep pace with the increasing complexity of devices, browsers, and payment methods.

In our previous post, we explored why financial institutions need test automation and introduced a few real-world deployments of Apptest.ai in the finance sector. Today, we take a deeper look at one of those cases: a leading card company (referred to here as Company A) that has partnered with Apptest.ai for over four years.

This case study shows how a leading card company leveraged Apptest.ai’s AI-driven test automation platform to continuously validate its payment systems, enhance reliability, and reduce costs.

2. Test Overview: Automating Payment Validation

Unlike typical mobile app testing, the goal in this project was to ensure that every payment transaction made with Company A’s cards was processed correctly under all real-world conditions.

To achieve this, Company A implemented hundreds of test cases combining four key factors:

- Merchant type 🏬

- Operating system 💻

- Browser 🌐

- Payment method 💳

By covering these permutations, the QA team simulated real customer transactions at scale.

Instead of investing costly on-premise infrastructure, Company A adopted Apptest.ai’s SaaS-based testing environment, while using dedicated devices to meet compliance.

To minimize costs, the card limit was intentionally lowered so that test transactions would be declined — yet still trigger the same payment authorization workflow. This approach ensured full-path coverage without real financial losses.

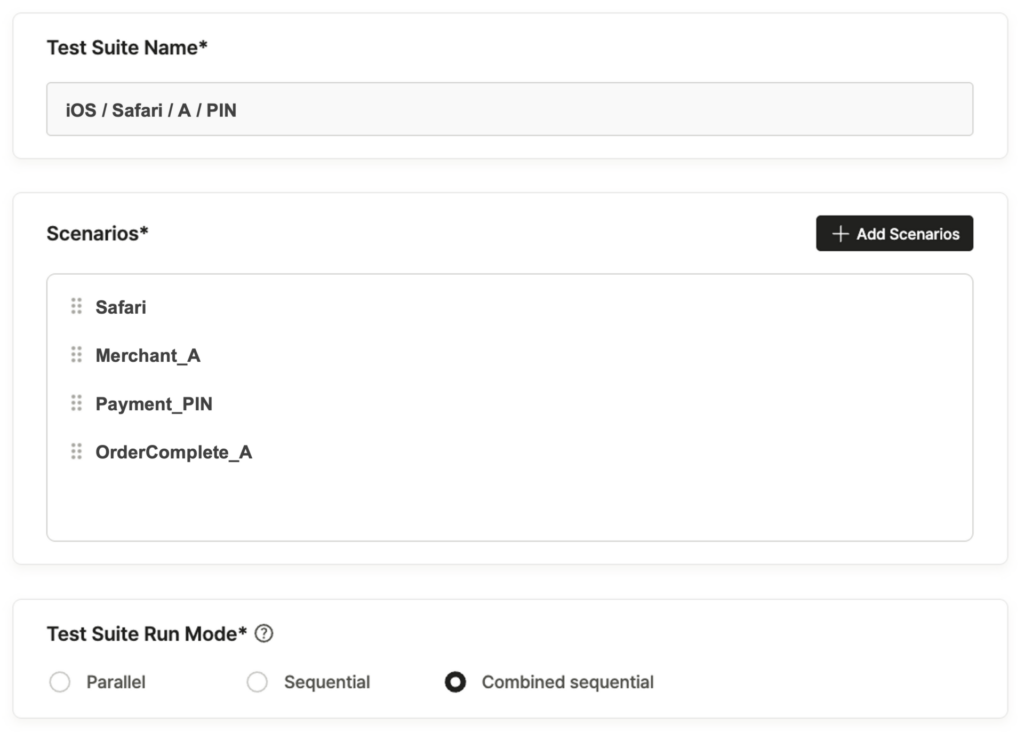

3. Scenario Design: Modular Test Automation

Each automated payment scenario was divided into four reusable modules, enabling modularity and scalability:

- Launch browser and Navigate to merchant product page 🚀

- Initiate purchase 🛒

- Attempt payment using Company A’s card 💳

- Verify result page for declined transaction (limit exceeded) ❌

With Apptest.ai’s modular scenario builder, QA engineers could easily vary browsers, merchants, and card configurations — assembling them into complex test suites that covered hundreds of combinations with minimal manual effort.

This modular approach dramatically reduced redundancy and accelerated scaling across hundreds of test cases.

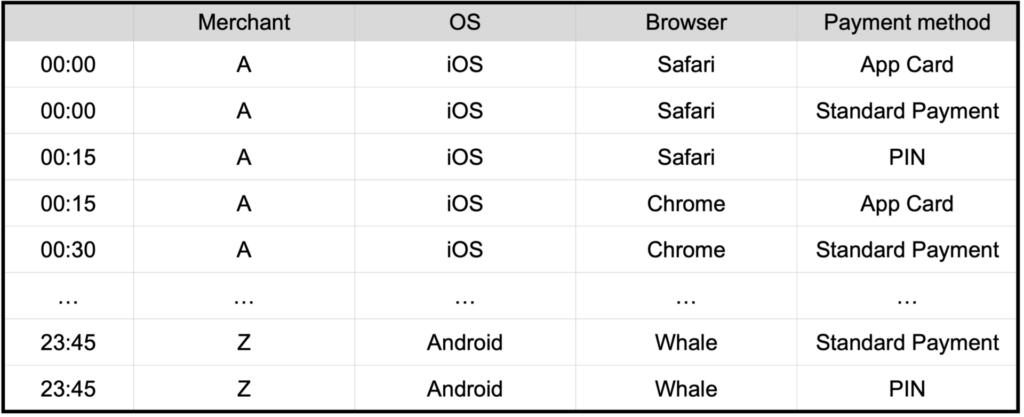

4. Test Scheduling: Continuous Testing for Payment Reliability

Although a single payment scenario runs in under five minutes, Company A schedules executions every 15 minutes to allow for:

- Device resets

- Heat and performance stabilization

This setup enables 24/7 continuous testing, ensuring real-time validation of payment workflows.

The continuous QA process provides early defect detection and confidence that payment systems remain stable under all operating conditions.

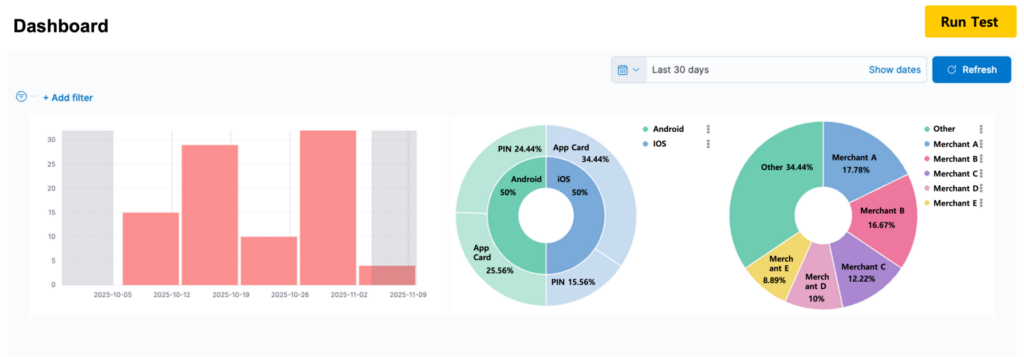

5. Custom Dashboard: Real-Time QA Analytics for Fintech

Apptest.ai provided Company A with a customized dashboard for real-time monitoring and insights.

Key metrics include:

- Failure ratio by payment type

- Failure ratio by merchant

- Failure ratio by browser

- Weekly trend of failed transactions 📊

These analytics dashboards help QA engineers and executives quickly identify recurring issues, prioritize fixes by business impact, and measure overall reliability improvements across the digital payment ecosystem.

6. Results and Benefits

By adopting AI-driven test automation with Apptest.ai, Company A achieved measurable results:

- ✅ Automated complex and repetitive payment validation workflows

- 💰 Reduced operational QA costs and manual workload

- 📈 Improved visibility into payment reliability and customer experience

- 🔁 Established continuous testing and early failure detection

This case illustrates how Apptest.ai enables financial institutions to scale QA operations, deliver seamless digital payment experiences, and future-proof mission-critical systems through AI-powered testing.

Related Posts

Learn how Apptest.ai can automate your payment testing workflows.

👉 Request a Demo or visit www.apptest.ai to explore our AI-driven testing solutions for fintech.