Why Financial Institutions Must Adopt Test Automation: FSS Guideline and Real-World Implementations

In November 2023, Korea’s Financial Supervisory Service (FSS) — a government agency overseeing financial stability — released the Guideline for Strengthening Financial IT Stability, establishing a higher standard for financial institutions. The guideline was developed jointly with seven financial associations through a task force launched in March 2023, aimed at addressing recurring IT failures and strengthening digital finance reliability.

With the rapid expansion of digital financial services, system failures can cause severe inconvenience for consumers and even broader social disruption. The FSS guideline responds to this risk by setting minimum standards for program errors, contingency planning, and performance management. It also reflects lessons learned from IT inspections and industry best practices, encouraging financial institutions to take proactive, self-driven measures to improve their internal IT controls.

Beyond reliability and security, the guideline emphasizes the requirement to leave verifiable test evidence. For banks, card companies, and securities firms, this marks a turning point: manual testing is no longer sufficient. Test automation has become a necessity, not a choice.

This post highlights the core message of the FSS guideline and shares three real-world cases where Apptest.ai successfully implemented FSS Guideline Test Automation for leading financial institutions.

Why the FSS Guideline Test Automation Matters

The 2023 guideline requires financial organizations to:

- Strengthen monitoring and resilience – enabling continuous detection of service failures and minimizing downtime.

- Automate testing for critical services – ensuring reliability in high-frequency, high-risk functions such as payments, logins, and transactions.

- Maintain evidence of tests – keeping detailed execution logs, screenshots, and results for future audits or incident reviews.

By raising the overall standard of IT internal controls, the guideline fosters an environment where financial institutions can autonomously and fundamentally resolve operational weaknesses. Test automation is the most effective path to achieve this, providing repeatability, accuracy, and traceability — directly aligning with regulatory demands.

💳 Case 1: Credit Card Companies – SaaS-based Real-Time Payment Monitoring

Scope: Real-time monitoring of card payment services via SaaS subscription (6,000 hours annually).

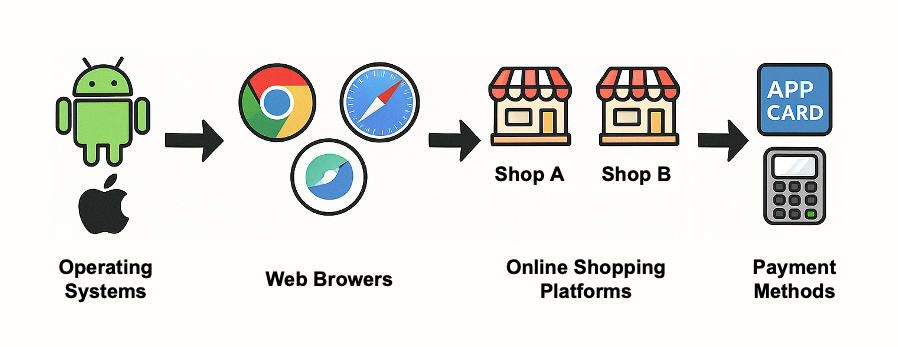

Approach: Apptest.ai developed an automation platform that replicates real customer environments. It directly interacts with partner websites and apps, executing full payment flows — including app card, simple payment, and PIN-based transactions.

Outcome: Continuous monitoring ensures payments are processed without disruption, with immediate detection of service failures.

📈 Case 2: Financial Security Companies – Continuous Monitoring of Core Functions

Scope: Automated monitoring of critical app functions (login, payments, push notifications, account inquiries) across 12 real devices.

Approach: Test cases were defined for core workflows and executed on a fixed schedule. Any deviation from expected UI values triggered error flags, detailed logs, and real-time notifications to responsible teams.

Outcome: Financial security companies can continuously validate live services while maintaining comprehensive test evidence for regulatory and operational assurance.

🏦 Case 3: Savings Bank Companies – Fast Validation of Production System

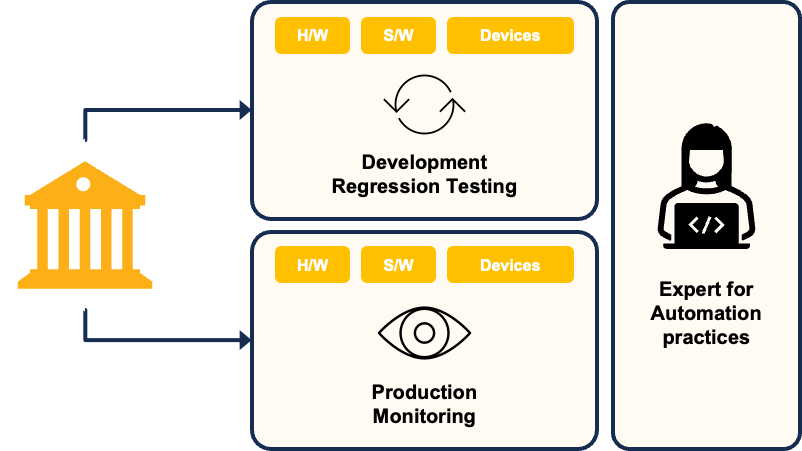

Scope: Dual deployment — 12 devices for regression testing during development and 6 devices for production monitoring.

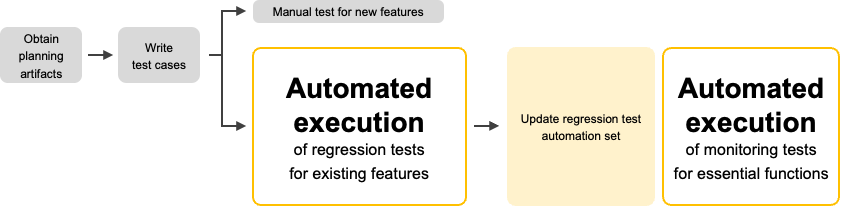

Approach: Apptest.ai provided two automation sets:

- Development: Regression testing to validate ongoing feature updates.

- Operations: Continuous monitoring of mission-critical functions in production.

Additionally, Apptest.ai deployed experts for one month to help design initial test scenarios and establish baseline automation practices.

Outcome: Faster validation during development and stronger production monitoring ensured end-to-end stability.

Strategic Implications for Financial Institutions

Regulators now demand evidence, reliability, and resilience — all of which can only be achieved through automation. Manual testing cannot meet these expectations at scale.

That’s why leading financial institutions like credit card companies, financial security companies, and savings banks have already embraced Apptest.ai. Our platform empowers financial organizations to:

- Ensure full compliance with the Guideline for Strengthening Financial IT Stability.

- Proactively address program errors, contingency gaps, and performance issues.

- Continuously validate mission-critical services with real-time monitoring.

- Reduce manual overhead while increasing operational efficiency.

If your organization is preparing for regulatory audits or aiming to strengthen service reliability, it’s time to adopt Apptest.ai. Let automation turn compliance into a competitive advantage. Request a Demo